Making wise financial decisions includes setting aside money for future needs and wants. “Things to save your money for” refers to the specific goals and objectives that motivate individuals to save a portion of their income. These goals can range from short-term, near-term, and long-term objectives.

Saving money offers numerous benefits and advantages. It provides a financial safety net for unexpected expenses, reduces financial stress, and allows individuals to make informed decisions about significant purchases. Moreover, saving money can help individuals achieve their financial goals, such as purchasing a home, funding higher education, or retiring comfortably.

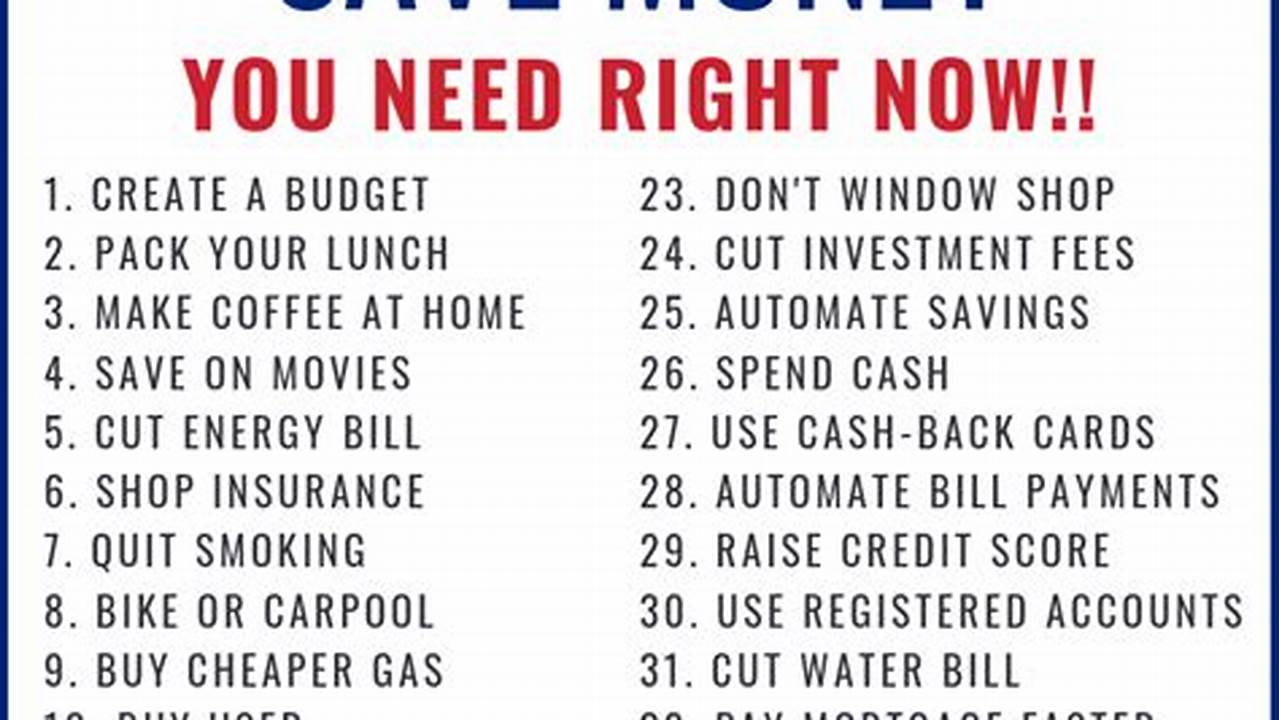

There are various strategies and approaches to saving money. Creating a budget, tracking expenses, and reducing unnecessary spending are fundamental steps towards effective saving habits. Additionally, exploring different saving options, such as high-yield savings accounts, money market accounts, or certificates of deposit, can help maximize returns on saved funds.

Frequently Asked Questions about Saving Money

Saving money is an essential aspect of personal finance, but it can also be challenging. Here are answers to some frequently asked questions about saving money:

Question 1: Why is it important to save money?

Saving money provides financial security and stability. It allows you to cover unexpected expenses, reach your financial goals, and retire comfortably. Additionally, saving money can reduce financial stress and provide peace of mind.

Question 2: How much money should I save?

The amount of money you should save depends on your individual circumstances, financial goals, and risk tolerance. A good rule of thumb is to aim to save at least 10-20% of your income each month.

Question 3: What are some good ways to save money?

There are many ways to save money, such as creating a budget, tracking your expenses, reducing unnecessary spending, and negotiating lower bills. Additionally, exploring different saving options, such as high-yield savings accounts, money market accounts, or certificates of deposit, can help you maximize your returns.

Question 4: What are some common mistakes people make when saving money?

Some common mistakes people make when saving money include not setting realistic goals, not having a plan, not automating savings, and not investing for the long term.

Question 5: How can I stay motivated to save money?

Staying motivated to save money requires setting clear goals, tracking your progress, and rewarding yourself for reaching milestones. Additionally, surrounding yourself with positive influences and seeking support from others can help you stay on track.

Question 6: What should I do if I have debt?

If you have debt, it is important to prioritize paying it off as quickly as possible. Consider creating a debt repayment plan, consolidating your debts, or exploring debt relief options if necessary.

Saving money is a journey, not a destination. It requires discipline, consistency, and a long-term perspective. By understanding the importance of saving money, setting realistic goals, and adopting effective strategies, you can build a solid financial foundation and achieve your financial aspirations.

Tips for Saving Money

Saving money requires a combination of planning, discipline, and smart financial habits. Here are five tips to help you save money:

Tip 1: Set financial goals

Having clear financial goals will help you stay motivated and focused on saving. Determine your short-term, mid-term, and long-term financial objectives, such as saving for a down payment on a house, funding your child’s education, or retiring comfortably.

Tip 2: Create a budget

A budget is a plan for how you will spend your money each month. It helps you track your income and expenses, identify areas where you can cut back, and allocate funds towards your savings goals.

Tip 3: Reduce unnecessary expenses

Take a close look at your expenses and identify areas where you can reduce spending. This could include cutting back on entertainment, dining out, or subscriptions. Consider negotiating lower bills for services such as phone, internet, or insurance.

Tip 4: Automate your savings

Set up automatic transfers from your checking account to a dedicated savings account on a regular basis. This will help you save money without having to think about it.

Tip 5: Explore different saving options

There are various saving options available, each with its own advantages and disadvantages. Consider high-yield savings accounts, money market accounts, certificates of deposit, or investing in stocks and bonds. Research and compare different options to find the one that best suits your needs and risk tolerance.

Key Takeaways:

- Setting clear financial goals will provide direction and motivation for saving.

- Creating a budget will help you control your spending and allocate funds towards your savings.

- Reducing unnecessary expenses will free up more money for saving.

- Automating your savings will make saving effortless.

- Exploring different saving options can help you maximize your returns.

By following these tips, you can develop effective saving habits and achieve your financial goals.

Conclusion

In conclusion, “things to save your money for” encompass a wide range of financial goals and objectives that motivate individuals to set aside a portion of their income. Saving money offers numerous benefits, including financial security, reduced financial stress, and the ability to make informed decisions about significant purchases and long-term financial aspirations.

This article has explored various aspects of saving money, including the importance of setting financial goals, creating a budget, reducing unnecessary expenses, automating savings, and exploring different saving options. By adopting these strategies, individuals can build a solid financial foundation and achieve their financial aspirations.