“How to save money with no money” is a concept that focuses on finding ways to reduce expenses and accumulate savings even when there seems to be no disposable income. It involves adopting frugal habits, exploring alternative options, and utilizing resources effectively. For instance, instead of making impulse purchases, one can opt for generic brands, cook meals at home, and seek discounts or coupons.

Saving money with no money holds immense significance as it promotes financial stability, reduces debt, and provides a safety net for unexpected expenses. Historically, individuals have employed various strategies to save money during challenging economic times, such as bartering, sharing expenses, and making do with less.

To delve deeper into the topic, let’s explore specific methods for saving money with no money, including reducing unnecessary expenses, maximizing income, and seeking financial assistance programs.

FAQs on “How to Save Money with No Money”

The following frequently asked questions provide concise answers to common concerns and misconceptions surrounding the topic of saving money with no money:

Question 1: Is it really possible to save money with no money?

Yes, it is possible to save money even when you have no disposable income. By adopting frugal habits, exploring alternative options, and utilizing resources effectively, you can gradually accumulate savings.

Question 2: What are some practical tips for saving money with no money?

Practical tips include reducing unnecessary expenses, maximizing income through side hustles or part-time work, and seeking financial assistance programs if eligible.

Question 3: How do I stay motivated to save money with no money?

Set realistic savings goals, track your progress, and seek support from friends or family to stay motivated.

Question 4: What are some common mistakes to avoid when saving money with no money?

Common mistakes include giving up too easily, failing to plan a budget, and making impulse purchases.

Question 5: How can I save money on essential expenses like housing and food?

Explore affordable housing options, cook meals at home, and utilize community resources for food assistance.

Question 6: Where can I find more resources on saving money with no money?

Non-profit organizations, government agencies, and online platforms offer valuable resources and guidance on saving money.

In summary, saving money with no money requires a combination of resourcefulness, discipline, and a commitment to financial well-being.

Let’s move on to the next section, where we will discuss specific strategies for reducing expenses and maximizing income.

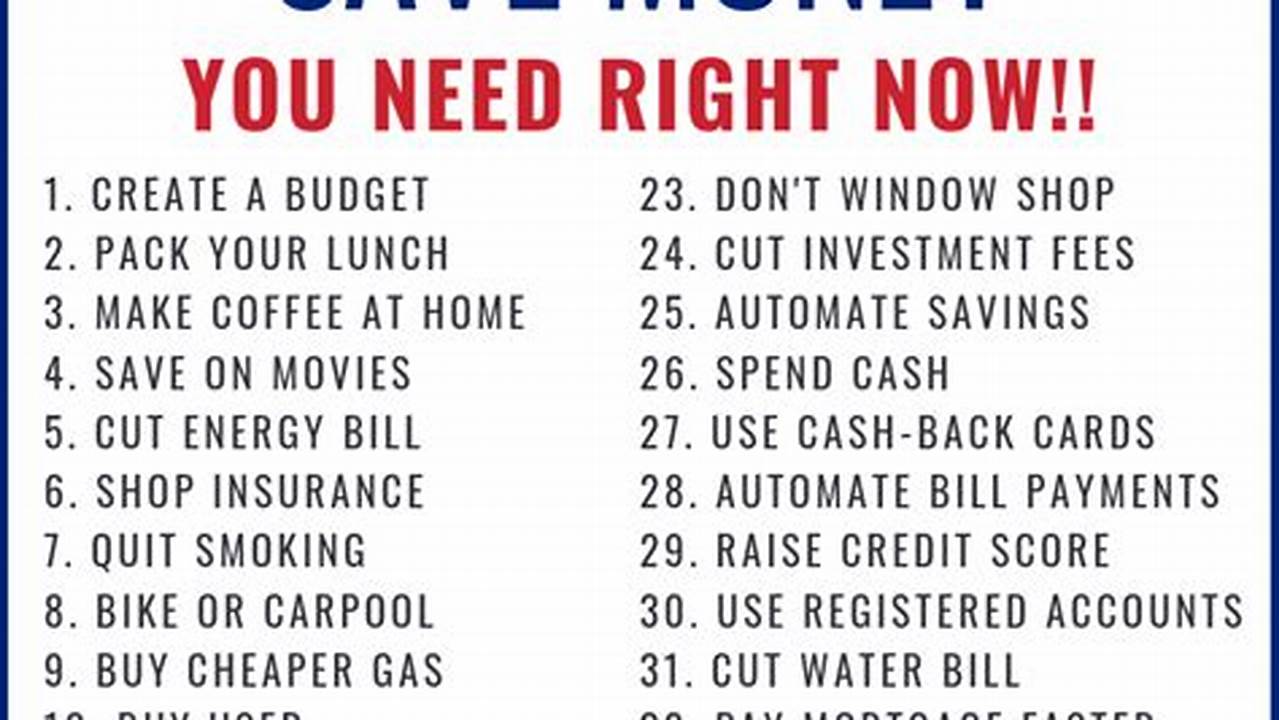

Tips on “How to Save Money with No Money”

Saving money with no money requires a strategic approach. Here are some effective tips to help you get started:

Tip 1: Reduce Unnecessary Expenses

Identify areas where you can cut back on non-essential spending, such as entertainment, dining out, or subscriptions. Consider negotiating lower bills for services like phone or internet.Tip 2: Explore Alternative Options

Look for ways to save money on essential expenses. Consider using public transportation instead of driving, buying generic brands, or borrowing items from friends instead of purchasing them.Tip 3: Increase Your Income

Explore opportunities to earn extra income through side hustles, part-time work, or selling unwanted items. Even a small additional income stream can make a significant difference.Tip 4: Seek Financial Assistance

If eligible, research government assistance programs, non-profit organizations, or community resources that provide financial aid for housing, food, or other expenses.Tip 5: Cook Meals at Home

Eating out can be expensive. Save money by preparing meals at home using affordable ingredients. Consider meal planning and shopping at discount grocery stores.Tip 6: Utilize Free Resources

Take advantage of free resources such as community events, libraries, or online educational platforms to save on entertainment, learning, and other expenses.Tip 7: Track Your Expenses

Keep track of your income and expenses to identify areas where you can save money. Use a budgeting app or simply write down your transactions in a notebook.Tip 8: Set Realistic Goals

Avoid setting unrealistic savings goals. Start with small, achievable targets to stay motivated and avoid discouragement.

By implementing these tips, you can gradually save money even when faced with financial constraints. Remember to be patient, disciplined, and resourceful in your approach.

Moving forward, let’s explore additional strategies for maximizing your savings and achieving financial stability.

Conclusion

In the face of financial constraints, saving money can seem like an insurmountable challenge. However, by adopting resourceful strategies and cultivating a disciplined approach, it is possible to save money even when starting with nothing. This article has explored the concept of “how to save money with no money,” providing practical tips and emphasizing the significance of reducing expenses, maximizing income, and utilizing available resources.

The key to successful money management lies in understanding that saving is a gradual process that requires patience and consistency. By implementing the tips outlined in this article, individuals can gradually build their savings, reduce debt, and achieve greater financial stability. Remember, every small step towards saving contributes to a more secure financial future.