Saving money at home is a crucial aspect of financial planning. It involves implementing strategies to minimize expenses and maximize savings within the household. The “best way to save money at home” encompasses a range of practical techniques aimed at reducing costs while maintaining a comfortable lifestyle.

The importance of saving money at home cannot be overstated. It provides a financial cushion for unexpected expenses, allows for future investments, and reduces reliance on debt. In today’s economic climate, where inflation and rising costs are prevalent, saving money has become more critical than ever.

To delve into the main topics of this article, we will explore effective methods for reducing household expenses, such as cutting back on unnecessary purchases, negotiating lower bills, and utilizing energy-saving techniques. We will also discuss strategies for increasing income through side hustles, passive income streams, and career advancement. Additionally, we will provide tips for budgeting, debt management, and long-term financial planning to help you achieve your financial goals.

Frequently Asked Questions on “Best Way to Save Money at Home”

The following are common questions and answers related to saving money at home:

Question 1: What are the most effective ways to reduce household expenses?

Answer: Some effective ways to reduce household expenses include cutting back on unnecessary purchases, negotiating lower bills, and utilizing energy-saving techniques.

Question 2: How can I increase my income to save more money?

Answer: Strategies for increasing income include starting a side hustle, pursuing passive income streams, and seeking career advancement opportunities.

Question 3: What is the best way to budget and manage debt?

Answer: To effectively budget and manage debt, consider creating a budget, prioritizing essential expenses, and exploring debt consolidation options.

Question 4: How can I plan for my financial future?

Answer: Long-term financial planning involves setting financial goals, investing wisely, and planning for retirement.

Question 5: What are some common mistakes to avoid when saving money?

Answer: Common mistakes include failing to set financial goals, not tracking expenses, and relying too heavily on credit.

Question 6: Where can I find additional resources and support for saving money?

Answer: Consider consulting with a financial advisor, utilizing online budgeting tools, and exploring government assistance programs.

In summary, saving money at home requires a combination of expense reduction strategies, income-generating activities, and responsible financial management. By implementing these principles, individuals can achieve financial stability and work towards their long-term financial goals.

Proceed to the next article section for further insights on saving money at home.

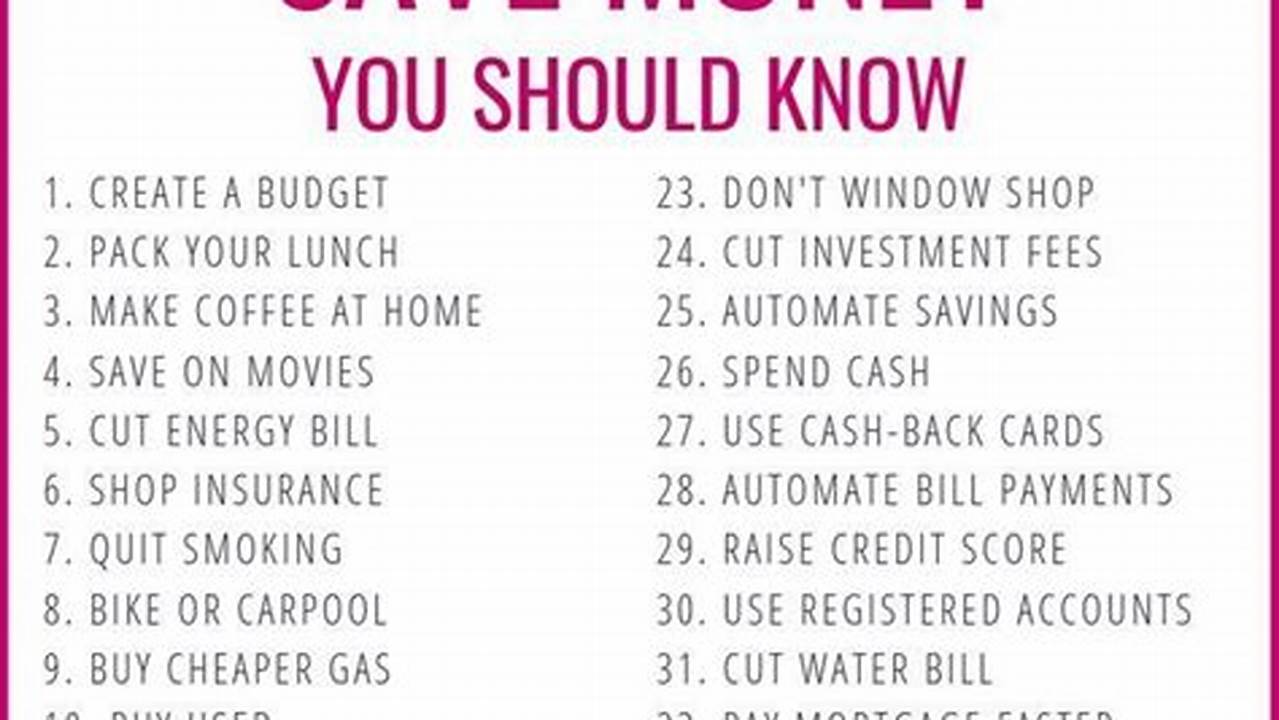

Tips for Saving Money at Home

Adopting the following tips can effectively help you save money at home:

Tip 1: Create a Budget and Track Expenses

Creating a budget outlines your income and expenses, providing a clear picture of your financial situation. Regularly tracking expenses helps identify areas where you can reduce spending.

Tip 2: Negotiate Lower Bills

Contact service providers, such as your phone or internet company, to negotiate lower bills. Explain your financial situation and inquire about any available discounts or promotions.

Tip 3: Reduce Energy Consumption

Implement energy-saving measures like switching to energy-efficient appliances, turning off lights when leaving a room, and unplugging electronics when not in use.

Tip 4: Cook Meals at Home

Eating out is expensive. Cooking meals at home allows you to control ingredients and portion sizes, saving money while promoting healthier eating habits.

Tip 5: Shop Around for Insurance

Compare quotes from different insurance providers for home, auto, and health insurance. Switching to a more affordable provider can result in significant savings.

Tip 6: Take Advantage of Free Activities

Explore free or low-cost entertainment options such as visiting local parks, attending community events, or borrowing books from the library.

Tip 7: Consider a Side Hustle

Supplement your income with a part-time job, freelance work, or starting a small business. This additional income can be directed towards savings.

Tip 8: Automate Savings

Set up automatic transfers from your checking account to a dedicated savings account. This ensures regular contributions towards your financial goals.

Incorporating these tips into your financial routine can lead to substantial savings over time. Remember to consistently track your expenses, explore additional cost-cutting opportunities, and make saving a priority.

Proceed to the next article section to learn more about the benefits of saving money at home.

Conclusion

In conclusion, saving money at home is a multifaceted endeavor that requires a combination of strategic planning, discipline, and a commitment to long-term financial well-being. Throughout this article, we have explored practical techniques for reducing expenses, increasing income, and managing finances responsibly.

By implementing these strategies, individuals can not only weather financial storms but also build a solid financial foundation. Saving money at home empowers us to achieve financial freedom, pursue our dreams, and secure a brighter future. Let us all strive to become masters of our finances, embracing the “best way to save money at home” for a life of financial abundance and peace of mind.