Saving money is the act of setting aside a portion of one’s income to cover future expenses or financial goals. It involves creating a budget, tracking expenses, and making conscious choices about spending habits.

Saving money has numerous benefits. It provides a financial cushion for unexpected expenses, helps achieve long-term financial goals such as retirement or a down payment on a house, and reduces financial stress and anxiety.

To save money effectively, one must first create a budget that outlines their income and expenses. This helps identify areas where spending can be reduced or eliminated. Additionally, tracking expenses through a budgeting app or spreadsheet can help identify unnecessary purchases and pinpoint areas for improvement.

FAQs on How to Save Little Money

This section addresses common questions and concerns related to saving money, providing informative answers to help individuals improve their financial habits.

Question 1: Why is it important to save money?

Answer: Saving money is important because it provides financial security, helps achieve long-term goals, and reduces stress.

Question 2: How much money should I save each month?

Answer: The amount you save each month depends on your financial situation and goals. A good starting point is to save 10-15% of your income.

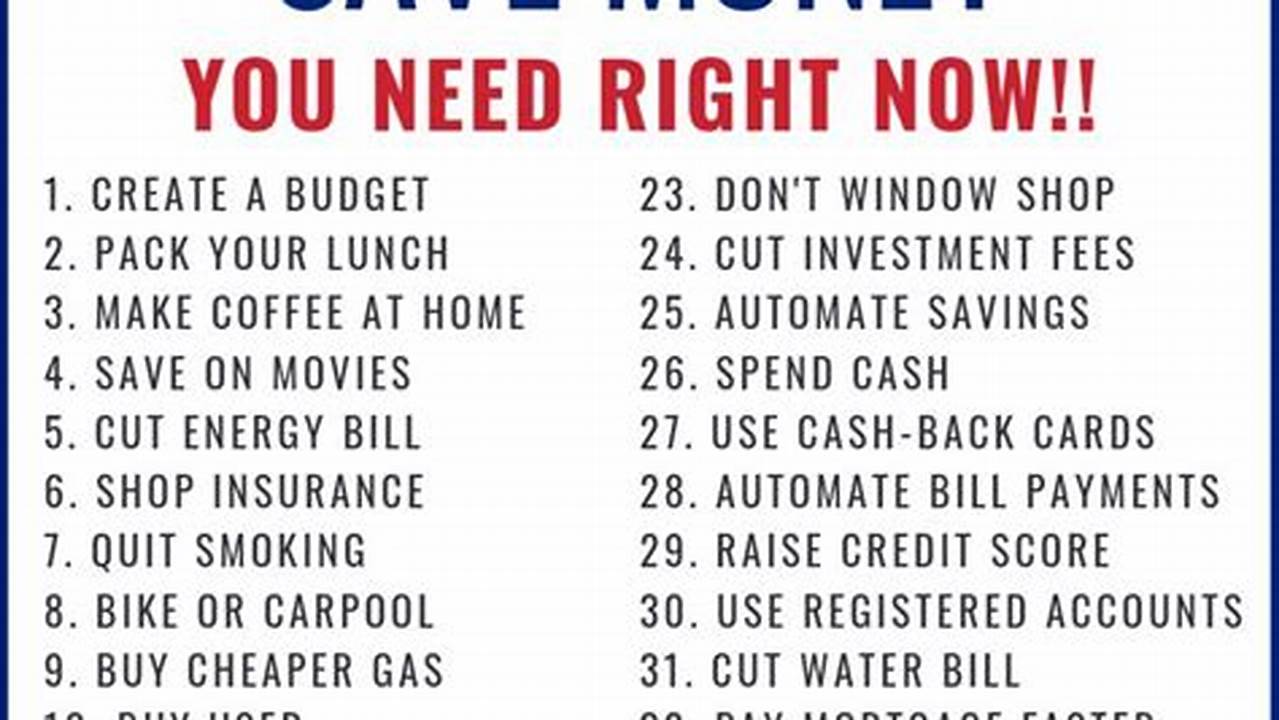

Question 3: What are some easy ways to save money?

Answer: Some easy ways to save money include creating a budget, tracking expenses, cutting unnecessary expenses, and negotiating bills.

Question 4: Is it possible to save money while living paycheck to paycheck?

Answer: Yes, it is possible to save money while living paycheck to paycheck. Start by creating a budget and identifying areas where you can reduce spending.

Question 5: What are some common mistakes people make when saving money?

Answer: Some common mistakes people make when saving money include not having a budget, spending more than they earn, and not setting realistic savings goals.

Question 6: How can I stay motivated to save money?

Answer: To stay motivated to save money, set realistic goals, track your progress, and reward yourself for reaching milestones.

Saving money requires discipline and planning, but it is essential for financial well-being. By following these tips and addressing common concerns, individuals can develop effective saving habits and achieve their financial goals.

For more information on saving money, please refer to the following resources:

Tips on How to Save Little Money

Saving money doesn’t have to be difficult. By following these simple tips, you can start saving money today.

Tip 1: Create a budget.

A budget is a plan for how you will spend your money each month. It helps you track your income and expenses so that you can see where your money is going. Once you know where your money is going, you can start to make changes to save more.

Tip 2: Track your expenses.

Once you have a budget, start tracking your expenses. This will help you see where you are spending the most money. Once you know where your money is going, you can start to make changes to save more.

Tip 3: Cut unnecessary expenses.

Once you have tracked your expenses, you can start to cut unnecessary expenses. This could include things like eating out less often, cutting back on entertainment spending, or canceling subscriptions that you don’t use.

Tip 4: Negotiate your bills.

Many bills can be negotiated. This includes things like your phone bill, internet bill, and even your rent. If you are willing to negotiate, you could save a significant amount of money each month.

Tip 5: Shop around for insurance.

Insurance is a necessary expense, but it doesn’t have to be expensive. By shopping around for insurance, you could save a significant amount of money each year.

Tip 6: Save your spare change.

Every little bit counts. If you start saving your spare change, you could be surprised at how much money you can save over time.

Tip 7: Get a side hustle.

If you need to save more money, consider getting a side hustle. This could be anything from driving for Uber to selling products online.

Tip 8: Set financial goals.

Having financial goals will help you stay motivated to save money. Whether you are saving for a down payment on a house or a new car, having a goal will help you stay on track.

Summary of key takeaways or benefits:

By following these tips, you can start saving money today. Saving money doesn’t have to be difficult. With a little effort, you can reach your financial goals.

Transition to the article’s conclusion:

If you are serious about saving money, start by following these tips. With a little effort, you can reach your financial goals and live a more secure financial future.

Conclusion

Saving money is essential for financial security and achieving long-term goals. By creating a budget, tracking expenses, and making conscious spending choices, individuals can effectively save money and improve their financial well-being.

Embracing the principles of saving little money empowers individuals to take control of their finances, reduce financial stress, and build a more secure financial future. By adopting these strategies, individuals can unlock the potential for financial freedom and achieve their financial aspirations.